The Emotional Finance Programme is a highly regarded, transformative training designed to build emotional literacy and relational intelligence in financial services.

It’s for financial professionals who want to move beyond technical competence and enrich the way they show up and nurture their client relationships for better client and business outcomes.

This isn’t surface level communication training nor is it ‘woo woo’.

Grounded in the Emotional Finance Model - a proprietary framework and methodology which translates psychotherapeutic theory and practice specifically for financial services - this training is relevant, practical and immediately applicable.

Financial Professionals can join open cohorts which run throughout the year, or the programme can be run in-house for firms, with bespoke optionality.

The Emotional Finance Programme

The Impact

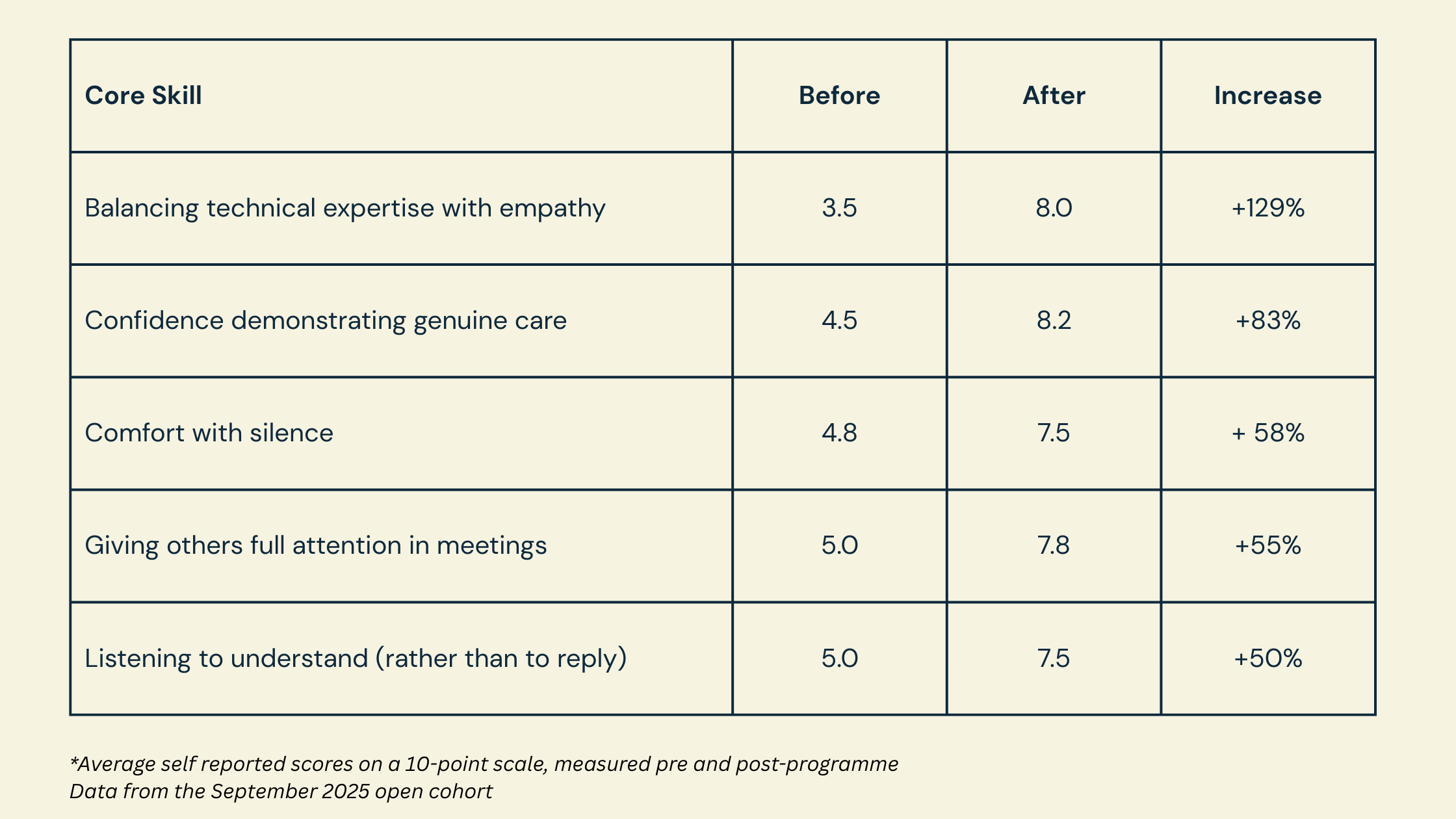

Participants in the Emotional Finance Programme report significant, measurable shifts in their emotional intelligence and relational skills - the kind that changes how they show up in every client conversation and impacts conversion, engagement and loyalty.

This isn’t training that gets forgotten when you’re back at your desk. It’s transformative and embeds through practice, integration and real world application.

When asked ‘How confident are you that you’ll continue applying what you’ve learned and practiced’ Participants rated it 9.5/10.

*Data from the September 2025 open cohort.

What participants say…

“I can honestly say it has been one of the most beneficial learning experiences of my training so far.”

James Smith, Verso Wealth Management.

“The impact has been nothing short of profound.”

Dan Haylett, TFP Planning.

“We’ve seen a meaningful uplift in the quality of client interactions, with a more collaborative and thoughtful approach that builds trust and understanding.”

Lee Waters, Barwells Wealth

“The course has had a much bigger impact on me than I expected going into it, and I’m really pleased with what I’ve taken away from it.”

Luke Budd, Scion Financial

Who It’s For.

The Emotional Finance Programme is designed for financial professionals and firms who want to improve their emotional literacy and relational intelligence for better client and business outcomes.

There are two streams within the programme:

Client Ready:

For early-career, or newly/ soon to be client-facing professionals - advisers, paraplanners, client relationship managers and trainees - who want to build confidence, presence, and trust in client relationships. This stream equips participants to:

Feel confident in real world client conversations

Know and articulate their value and credibility

Show up with composure and presence, even when conversations are emotional, unpredictable or high stakes

Engage clients with professionalism and authenticity and become a trusted ‘go-to’

Client Alchemy:

For experienced advisers and leaders who already have strong soft skills but want to go deeper or approach them from a new perspective. This stream equips participants to:

Be better able to navigate complex emotional dynamics with ease and clarity

Address recurring challenges and blind spots

Move from relationships that rely on rapport to those grounded in deep trust and alignment.

Find space and support for reflection, feedback, and growth that enhances both personal fulfilment and commercial impact.

Both streams are built around the same Emotional Finance Model, offering a shared approach that can be developed across teams and firms — creating consistency, trust, and a truly client-centred and collaborative culture.

How it Works.

The Emotional Finance Programme blends group tutorial-style learning, exercises, discussion and case studies alongside demonstration and practice.

Participants engage with Emotional Finance - not just as theory, but in practical ways that make sense and embed learning in practical and immediately applicable ways. We move between structured teaching and live case studies - through real scenarios, reflections, mentoring and feedback - so insights don’t just make sense, they stick.

Open Cohorts (a mixed group of up to 10 participants where individuals from different firms can book onto the same programme) include:

Four Live Sessions (Half Day): These are tutorial-style workshops combining conceptual teaching, reflective dialogue, and experiential exercises.

Four Practice & Integration Calls (90 mins): Between sessions, participants join smaller stream-specific groups to explore how the learning shows up in practice

1:1 Support & Integration: Each participant also has an individual pre-programme call to set intentions and a post-programme call to review progress and plan next steps - ensuring the learning is personal, relevant, and embedded.

Open cohorts offer a rich learning experience - bringing together a diverse mix of people, perspectives, and career stages in a safe, neutral space where ideas can flow freely.

Ready to join an Open Cohort in 2026?

In House Programmes:

Include everything in the open cohorts, plus complete flexibility in format and delivery and cohort sizes.

In House programmes create alignment, shared language and an opportunity for tailored learning - helping teams strengthen their relational skills in ways that directly support your firm’s culture and commercial goals.

Would you like to enquire about In House Programmes?

The Emotional Finance Programme Testimonials:

Your Investment.

OPEN COHORT PROGRAMMES:

Mixed group programmes (maximum 10) where individuals from different firms can book onto the same cohort.

The investment to join an open cohort is £1,750 per participant.

If you are self-funding, please get in touch - I offer flexible payment options and a small number of bursary places to support advisers at earlier career stages.

If you are a firm looking to send multiple participants, I offer volume discounts.

All terms and conditions can be found here.

FOR IN HOUSE PROGRAMMES:

Please get in touch to discuss.

Book a discovery call to find out more

Register to express your interest in 2026 cohorts.

FAQs.